The IDR Equation: When Does It Add Up?

Weighing the Costs and Benefits of Independent Dispute Resolution

This week I had the opportunity to participate in a panel discussion about the No Surprises Act at the Advanced Institute of Anesthesia Billing and Practice Management’s (AIABPM) annual conference. My main focus was on the cost of engaging in IDR.

Especially for small and medium-sized practices, can IDR cost-efficiently address unfair out-of-network reimbursement?

That’s a nuanced question, so first let’s take a look at some of the inputs to the equation:

Overhead

Your target reimbursement

IDR fees

Then we’ll review a formula for assessing the breakeven point, including with an interactive calculator I’ve published.

Overhead

Successfully navigating a single claim through IDR requires tracking numerous deadlines, calculating offer amounts, properly notifying and documenting communications with health plans regarding Open Negotiation and IDR initiation, inputting extensive data in multiple portals, drafting supporting offer documents, and more. And by the way, the “and more” also includes an endless stream of email communications.

Even with extensive automations built to extract data from emails into a database, click through portals, and assist with document generation, this process requires a steady hand (or team) to manage the day-to-day operations and respond to ad hoc requests by IDR entities requesting additional documentation.

How many FTEs? That depends on your current billing setup, access to automation resources, and volume of IDR-eligible claims.

Target Reimbursement

Next, assess your reimbursement potential. Looking at your current out-of-network reimbursement, how much lower is it than what you consider to be fair and reasonable?

For anesthesia, nearly all claims are based on a Conversion Factor which you multiply by the total units associated with a given CPT code. It’s relatively straightforward then to determine the % increase needed to reach your target Conversion Factor via IDR.

Some practices need to set higher target reimbursement rates due to egregious payer cuts. Others may be seeking smaller gains.

IDR Fees

Before we get into IDR Entity (IDRE) fees, we have to discuss batching. The current restrictive batching criteria force many providers to submit single claim Disputes into IDR – a significant barrier to making IDR cost-efficient. (And one that hopefully CMS’s Proposed Rules will eventually address!)

With that in mind, this analysis will assume single claim Dispute fee amounts.

The median IDRE fee is $600, with a range of $375-$800 (link to CMS). IDR entities can choose their fee amount within a CMS-approved range. For those unfamiliar, these IDRE fees are refundable if you win the Dispute.

There is also a $115 CMS administrative fee which is non-refundable.

Fee Expenses per Disputes

To get started, we’ll need to assume a Win Rate % for Disputes you submit. The average Win Rate % for providers has been ~80% so far according to data published by CMS, although that data is on a significant lag of 9+ months.

With these assumptions in place, the average IDR process fees for every Dispute you submit would be $235. The chart above shows the +/- $30 rate per 5% change in Win Rate %.

Which claims are worth submitting?

While you may be targeting a 50% increase in reimbursement across all your cases, there are likely to be plenty of cases where the IDR process fees alone make this a losing proposition.

This is a very, very important flaw in the current implementation of the No Surprises Act. Specialties with a) high volume and b) relatively low per-case reimbursement are more impacted by the restrictive batching criteria.

Think about it this way:

· Surgeon A performs 5 procedures and gets paid $10,000.

· Anesthesiologist B medically directs 20 procedures and gets paid $10,000.

Both providers are seeking a +50% increase in reimbursement through IDR. Due to restrictive batching, both Providers can only submit single claim Disputes. However, Anesthesiologist B is having to pay 4X the fees compared to Surgeon A, while seeking the same end result in reimbursement. The fees will erode much of the additional reimbursement Anesthesiologist A is seeking.

It just so happens that many of the specialties impacted by the No Surprises Act – namely anesthesia, radiology, pathology – have the same unfortunate high volume, low per case reimbursement characteristics.

Back to our calculation…

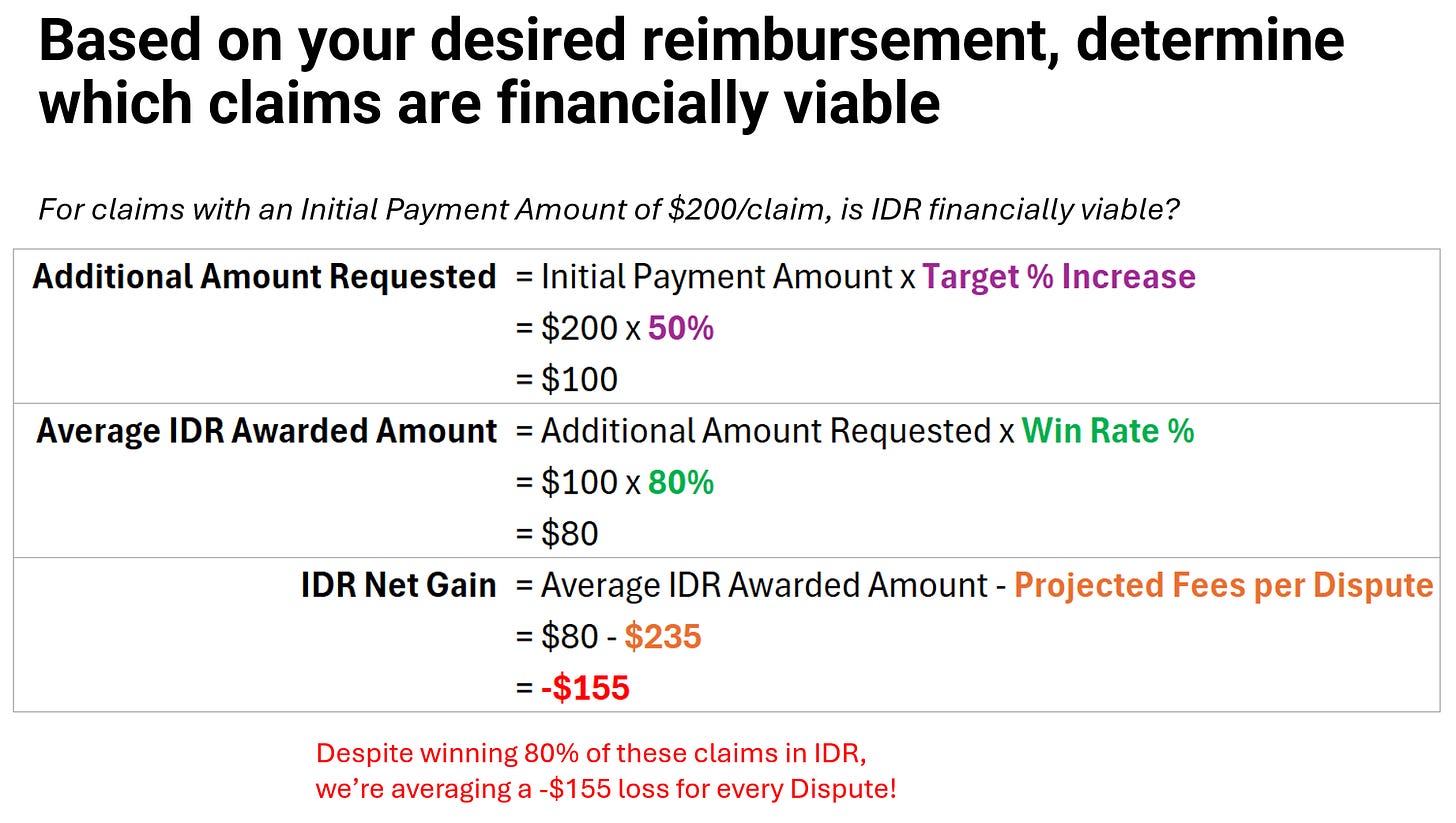

Let’s assume you are targeting a 50% increase in your current out-of-network reimbursement and the health plan’s initial out-of-network payment was $200.

Despite winning 80% of your Disputes at a +50% reimbursement, you’re net loss with fees is averaging -$155 per Dispute. And a reminder – that’s without any overhead considerations.

Using the above formula, we can analyze the net gain (or loss) at various Initial Payment Amounts.

You can check out the calculator here:

Conclusion

The Independent Dispute Resolution process represents both an opportunity and a challenge for healthcare providers. On one hand, it offers a mechanism to address unfair reimbursement practices and potentially increase revenue. On the other, it introduces new costs and complexities that can strain resources, especially for smaller practices.

As we've explored, the cost-effectiveness of IDR depends on a variety of factors, from overhead and fees to win rates and batching limitations. The key takeaway is that IDR is not a one-size-fits-all solution. It requires careful consideration and strategic implementation.

If you’ve found this helpful, please share this post. Feedback welcome!