Tuesday’s House Ways & Means hearing went about as expected, with committee members expressing their disappointment with the government’s implementation of their bipartisan No Surprises Act law. A few common themes:

Bipartisan passage of No Surprises Act → Amazing

Patients protected from surprise out-of-network bills → Wonderful

Implementation of law → Flawed

Insurers incentivized to terminate in-network contracts → Counter-productive

Enforcement of law → Lacking

Healthcare Providers

We also heard details from two witnesses in the hearing representing healthcare providers:

Dr. Seth Bleier, an emergency physician at an independent physician practice in North Carolina

Mr. Jim Budzinski, CFO of Wellstar Health System

They highlighted the many new challenges created by the flawed implementation, such as batching restraints and exorbitant administrative fees - sound familiar?

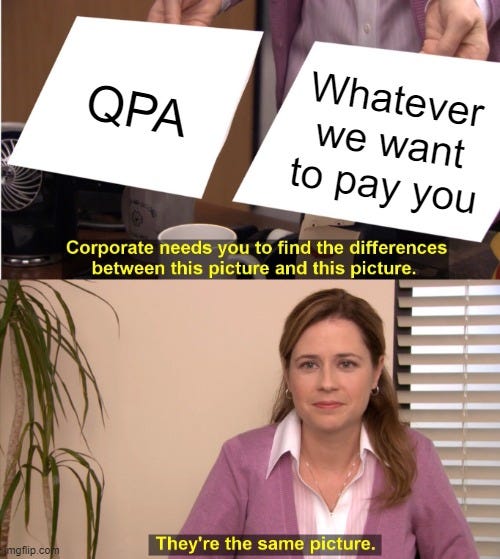

When Rep. Tenney brought up examples of nearly identical claims receiving vastly different QPAs attached to their EOBs, she asked Dr. Bleier for an explanation. He emphasized the Qualified Payment Amount’s (QPA) lack of transparency and its inconsistency - healthcare providers have no way to validate any of the underlying calculations.

Mr. Budzinski specifically identified low initial insurance payments as the key issue driving the large volume of claims submitted for IDR. If that’s not solved, the pace of claims entering arbitration will not slow down.

Dr. Greg Murphy (R-NC) chipped in with important comments on enforcement issues, saying the law lacked “teeth.” He intends to propose new legislation to correct this: any insurers with overdue payments following arbitration would be subject to a 1% fee compounding daily. Yes, please.

IDRE: Federal Hearings and Appeals Services

Mr. James Bobeck, president of FHAS, provided the perspective of an Independent Dispute Resolution Entity (IDRE). FHAS is a private dispute resolution firm that has handled a large proportion of the resolved NSA disputes thus far.

A very interesting data point he offered: Early on in the NSA arbitration process, only ~50% of submitted disputes were deemed eligible. However, that is closer to 87% now.

This is very important - CMS used early numbers on dispute volume to justify the huge jump in non-refundable admin fees from $50 to $350. The CMS argument is thus based on outdated information. It simply took a few months for providers to figure out the complex eligibility rules, such as bifurcated federal vs. state processes.

He also emphasized the importance of overhauling batching criteria.

Opening Statement

Here’s the beginning of Chairman Smith’s (R) opening statement:

“Three years ago, Congress passed the bipartisan No Surprises Act to end surprise medical bills for good. American patients were in desperate need of these protections as too many had come face to face with medical bills from being treated without their knowledge by an out-of-network doctor. It left them on the hook for tens and even hundreds of thousands of dollars in surprise medical expenses.

“This law has seen success in ending that crisis. Unfortunately, the new surprises for patients have come in the form of medical staff shortages, longer wait times, and fewer choices because of the federal government’s flawed implementation of the law.

“Three years ago the Ways and Means Committee led the bipartisan effort to draft the No Surprises Act, but agency rulemaking has unfortunately ignored congressional intent. It has created a tilted dispute resolution process that has left medical providers paying more to participate in a process that often forces them to accept artificially low payments with no enforcement guarantee. It has also led to legal challenges that have resulted in significant backlogs and left the process clouded in uncertainty.

“This law’s implementation has made the very problem it intended to fix worse, resulting in more medical providers no longer covered under health insurance networks. This leaves Americans paying more to access fewer doctors than ever before.

Now, back to waiting on the IDR portal’s reopening.